Factoring: Inventory and Accounts Receivable

In normal business practice, factoring refers to the sale of invoices to third parties. This helps businesses access cash even before their accounts receivable mature, and therefore, gives them the ability to secure new inventory. In other instances, businesses can acquire the inventory they need from a third party, sell the inventory, and then pay for the inventory with a certain fee on top.

While these factoring methods are highly beneficial, especially to small companies that are constantly cash-constrained and need quick turnaround times for their stock, they might also end up being very expensive, and in many cases, out of reach for businesses that are not yet established.

The inventory factoring method described above also means that small businesses are constantly in debt, or at the mercy of factoring companies. Between these two, a huge cost goes not to business operations, but to settling factoring fees.

NewVistas factoring

Community ownership of assets

Limited partners, once in the community, invest a minimum of $20,000 into the Capital Bank (agency 8), an invest for which they receive interest. They also open checking and savings accounts in the Commercial Bank (agency 9). The community then provides them with the necessary tools to set up their lives and business, including space, equipment, and inventory.

The community invests the funds invested by limited partners in the community. It owns these funds, as well as the physical and economic infrastructure that the funds help develop and sustain. While limited partners have contracts for their investment, they do not own it. They can certainly withdraw the funds in the Capital Bank if they wish to leave, but the withdrawal cannot be abrupt, nor a one-time affair. Instead, the investment can only be withdrawn at the rate. Of 2% a month, meaning at least 4 years are needed to completely divest from the community.

The same is the case for savings held in the Commercial bank. The community owns funds deposited here, and has a contract with the depositor. When they need to withdraw the money, they can only do so at the rate of 2% per day. In instances where they need more, they can coordinate with the bank for the rate to be increased for that day, and for a specific need.

Therefore, limited partners only own their businesses. They do not own the inventory they sell, nor the equipment they use to produce goods and services. These are owned by the villages, which take loans to buy them and put them under the responsibility of individual stewards as per their business needs. Businesses own the margin they make once they sell inventory. They are encouraged to invest this money as savings or in the Capital Bank, so that they can have higher returns, and have greater amount to withdraw following the 2% rule. Additionally, the community has more money at its disposal when people put more money into the banks.

These factors strengthen the banks’ ability to lend more, and prevents bank runs that can be devastating for limited partners and the community’s survival.

Inventory from village to businesses

When a business needs inventory, it notifies the Business Operations Agency, through the village presidency for the agency. The village president is assisted by an automated system to clarify details about the inventory and the applicant. Such details include:

- Expected turnover of the inventory

- Number of potential buyers

- Experience of the applicant with the product

These details are used to indicate to the village, the fee that will be charged for factoring. The details also indicate the risk involved in factoring, since the village does not want the applicant to hold on to inventory for too long and occasion the sub-optimal utilization of resources.

It is important to note that the village presidency for business operations does not operate a giant storehouse that has all manner of inventory to satisfy all needs of the businesses in that village. It operates more like an engine that connects different businesses and facilitates the transfer of custody or responsibility of inventory.

How factoring works

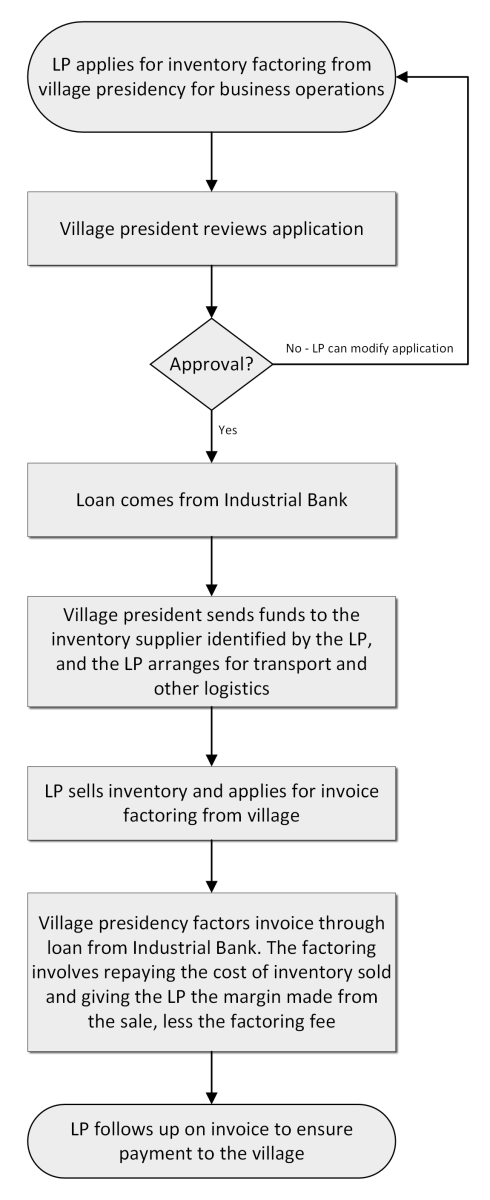

The appraisal process is quick since it is automated, and the agency has a huge amount of data that the system’s algorithm uses to quickly analyze, as well as the possible input of the captain. Where the presidency is not convinced that the inventory should be acquired by the village, it can ask the applicant and their captain for more information or recommend specific changes.

Once the presidency is satisfied that the inventory being requested has passed these steps, it approves and forwards a loan request to the Commercial Bank Agency. On receiving the loan, the presidency would ideally send the money to the supplier. In many cases, however, the inventory already belongs to the village, unless it is wholly produced by the supplying steward, such as farm produce. This means that the agency would deduct the value of the inventory it had factored, and forward the margin that the supplier has negotiated with the buyer.

For instance, a supplier of bulk honey may have bought his honey at $10 per pound from an apiary outside the community. This is the amount that was advanced to the apiary. Another business that makes cosmetics derived from honey wants to buy 100 pounds of the honey, and has agreed to a price of $14 per pound. Under these terms, the village would send the honey supplier $400, which is the profit from the sale, less a factoring fee, and. The village will then factor in the account receivable worth $1400. The account receivable will be payable to the community but will be followed up on by the honey supplier, not the village.

Accounting for community businesses

In modern accounting practice, a business’s health is defined by various things, among them a balance sheet, the business’s trading, profit, and loss account, cashflow statement, and other financial records providing both a snapshot of the business at a particular point and a statement of the business’s daily activities.

The balance sheet is an important tool for understanding how a business is doing at a particular point in time. A balance sheet is used by financial intermediaries and investors to view the assets they have, their exposure to debt, working capital, and other details.

A balance sheet includes details of fixed assets, current assets, and equity.

Fixed assets are equipment, plant and machinery, fixtures and fittings, vehicles, and land, among other items that cannot be easily liquidated. Current assets include cash, financial instruments, inventory, accounts receivable, and others assets that can quickly be liquidated. Liabilities include loans, accounts payable, and depreciation on assets. There are also intangible assets, including goodwill and intellectual property.

Community businesses, however, do not possess fixed assets. All these belong to the community, which rents them out through agencies. Their inventory is owned by the Enterprise Assets Agency, as are all accounts receivable. The community does not actively issue loans to businesses as working capital, but facilitates them to the fullest extent possible through factoring, leasing, and access to data and experts.

A sample balance sheet of a community-based enterprise would look as follows,

In this illustration, we will use the bulk honey supplier.

| ABC Honey Suppliers | |||||

| Trading, Profit, and Loss Account | |||||

| For the Year ended YYYY | |||||

| Debit | Credit | ||||

| Carriage inwards | Businesses pay to transport inventory from the supplier – these are not part of factoring cost | 1,000 | Sales Margins | Because there is no corresponding cost of sales besides carriage and loogistics, the statement will show the total margins realized after sale of factored inventory less other expenses | 60,000 |

| Logistics | They also pay for logistics, storage, and any other associated ccosts, which are part of cost of sales, but not part of actual cost of inventory | 1,500 | |||

| Gross Profit c/d | 57,500 | ||||

| 60,000 | 60,000 | ||||

| Less expenses | Gross profit b/d | 57,500 | |||

| Rent | Business rent includes rent of premises, but may also include euipment used including forkklifts, trolleys, etc | 10,000 | Other incomes: | ||

| Inventory factoring | This illustration assumes factoring at 2% of cost of inventory, which is 150,000 in this case. | 3,000 | Discounts received | The business may have bought more honey to get it at a cheaper cost, having made proper business planning to know how it will absorb the extra quantities | 200 |

| Invoice factoring | The same honey is sold for 210,000, with the community charging a 2% fee | 4,200 | Bad debt recovered | 500 | |

| Discount allowed on overdue stock | Some of the honey has overstayed at the store, and the business, eager to boost turnover and get new supplies, sells the honey at a discount | 400 | |||

| Advertisement | 300 | ||||

| Bad debts written off | Some of the honey may not be paid on time, despite being factored – the business is responsible for indemnfiying the community in such cases | 780 | |||

| Net profit c/d | 39,520 | ||||

| 58,200 | 58,200 | ||||

| Net profit b/d | 39,520 | ||||

Notes:

- Factoring for this example is assumed at 2%. A pound of honey costing 10 dollars will be sold at a margin of 4 dollars. Therefore, honey worth 150,000 sells at 210,000, fetching 60,000.

- Once accounts receivable cannot be collected, the debt will be absorbed by the issuing business

- Every business has around 150 ft2 for business, from which approximate rent is calculated.