Agency 16: Accounting

The sixteenth agency in the community is the Accounting Agency. It is the first agency in the Records and Knowledge Bureau. Other agencies in the bureau are Agency 17 (Publishing and Teaching) and Agency 18 (Metrics). The agency’s primary concern is facilitating proper financial reporting and data analysis among agencies and businesses. It does so by setting up systems, guidelines, and training needed.

The Capital Bank Agency (agency 8) receives investment in the form of partnership interest from limited partners, which it in turn invests in community agencies, including the Accounting Agency. Agencies use these funds for operations, including delivering chargeable services to participants. From their revenues, they pay the Capital Bank a return on its investment, which in turn enables the bank to pay limited partners handsome returns on their investments.

Roles of the Accounting Agency

The roles of the Accouniting Agency are varied, but all have to do with enabling community agencies and participants businesses to leverage information so that they can make sound decisions. In the community, different entities are continually collecting, storing, and processing information for different uses. They need access to advanced data analytics capabilities, which the Accounting Agency provides.

the community appreciates the central role financial management plays in business success. All businesses and agencies, as going concerns, have an important need for financial information. The information is used in making business plans, life plans, marketing and risk management strategies, among other important decisions and plans. The agency plays a central role in enabling access to automated financial management tools, certified accounting experts, and basic accounting knowledge that business owners need to be successful.

To deliver on these two main distinct, yet related responsibilities, the Accounting Agency performs the following roles:

- Facilitating financial reporting

- Developing and monitoring the application of accounting standards and guidelines

- Training and professionals’ accreditation

- Data management and analytics

- Cyber security and data integrity

Financial reporting

The Accounting Agency assists businesses and agencies to prepare financial reports that are systematic, accurate, and complete. This is indeed the definition of accounting: the art and science of keeping systematic, accurate, and complete financial information about a business. This information assists businesses in budgeting and planning.

The information also helps businesses to evaluate possible causes of action while helping other parties – including agencies, community public servants, and current and potential business collaborators to correctly establish the financial health of a business, as well as its prospects.

There are two main branches of accounting: financial and management accounting. Financial accounting refers to the recording, summarizing, and reporting of financial transactions about a business. Financial accounting is historically oriented, typically reporting on financial events that have already occurred.

The information that financial accounting summarizes and reports is usually for the consumption of external parties, including community agencies, who are interested in seeing how the business is doing to make better decisions about their engagement. Financial reporting tends to result in objective information, closely guided by generally accepted financial principles and guidelines.

Management accounting is concerned with analyzing and interpreting financial information to organize and manage a business. It is more detailed than financial reporting, providing important information such as cost accounting, profit per product, and other similar aspects. Management accounting is used to make decisions on marketing, resource allocation, and future financial projections.

While it includes historical data, management accounting is more focused on the future. It is mainly for internal consumption, as business owners try to use financial information to make business strategies. In these respects, management accounting is broader than financial accounting and contains sometimes subjective information.

The community, through the Accounting Agency, requires all businesses to keep proper books of accounts. This is a prerequisite before a business can meaningfully engage with other agencies for business support. For instance, the Asset Leasing Agency (Agency 3) needs to see financial information, including management accounting reports, to determine whether requested equipment is in line with the business’s current financial status.

The Accounting Agency provides businesses with accounting systems that enable proper financial reporting. The accounting systems are designed to be integrated with other agencies’ systems, including audit and banking agencies, to enable a seamless transfer of information and accuracy in reporting. Such integration also helps agencies and businesses as they make decisions, with accurate information at hand.

Accounting standards and guidelines

In contemporary accounting practice, Generally Accepted Accounting Principles (GAAP) are important as they help businesses assign transactions properly, and simplify bookkeeping. GAAPs are particularly important because they ensure the consistency, clarity, and continuity of financial reports. Books of accounts prepared with the same guidelines are easily comparable. Through GAAPs, business owners can easily evaluate possible strategic options, since they have a complete picture of a business’s state.

In the community, accounting books will be markedly different from the way accounting is done in modern businesses. For instance, businesses will not have any assets, besides the cash they have at the bank, and the business itself. This and other unique community features will necessitate the drawing up of principles to complement those already used by accountants today, with a view of standardizing accounting practice while accommodating special business features in NewVistas.

The Accounting Agency will facilitate the formulation and implementation of these standards, by providing a platform on which accountants can come together and deliberate. The agency will, through its system, ensure that these principles are followed and that they are consistent with the law, bylaws, and accounting best practice in the area within which a community operates.

Training and professional accreditation

Every business owner needs to have at least some basic understanding of accounting. This helps them in understanding the health of their business, operational inefficiencies, and their obligations concerning taxes, licenses, and regulator fees, among others.

The Accounting Agency runs automated training sessions for all business owners to ensure they are competent enough to read financial reports and make good conclusions from them. The agency develops these sessions with the help of contractors. They are made simple to understand and advance in sophistication as a business owner becomes more familiar with accounting.

The agency recommends regular refresher courses to help business owners keep up with changes in accounting practice, and to gradually expand their knowledge.

Besides the automated system, contractors extensively work with businesses to meet their accounting needs. The contractors, who are accountants, can help set up specialized accounting systems, tax accounting, management accounting, and other specializations designed to improve business efficiency.

The Accounting Agency strives to ensure that the services that participants receive are from qualified professionals. The agency accredits accounting professionals, to ensure that besides being qualified professionals, they are competent to practice in the unique circumstances of the NewVistas economic system.

Besides accreditation, the agency also facilitates regular training for professionals. Regular training boosts their business competitiveness, as the newly-acquired knowledge is is played on their profiles. While the agency may lack the manpower and resources to bee a monitor, it facilitates self-regulation by coordinating the establishment and operation of an accountants’ professional guild.

Data management and analytics

Data management is the process of collecting, storing, organizing, and maintaining data. Effective data management means that it is accurate, available, and accessible. The community generates and processes extensive amounts of information which help its agencies and businesses to perform optimally, employing data-based decision-making in all facets of life and business.

The Accounting Agency is responsible for ensuring that data is collected as it should, and is therefore complete, it is collected in its true form, and is therefore accurate, and that it is stored in an accessible way. The agency is constantly collecting and verifying information from participants, their businesses, and community agencies. It then ensures that the information is stored in ways that it can easily be accessed and analyzed.

Besides helping agencies and business to optimize data, the Accounting Agency ensures that data is collected, stored, and analyzed or accessed in line with policies and regulations that govern data handling. Through this, they can be able to make good decisions that propel them to greater efficiency and performance.

A key part of data management is having autonomous database management. This is the use of a cloud database that uses machine learning to automate database security, backups, updates, and routine maintenance. Through automation, human error, which is especially frequent if the data workload is enormous, is eliminated. This eliminates the possibility of poor performance and compromised security.

Data analytics involves extracting meaningful information and insights from data. This is important as it helps entities make sense of the information at their disposal. Without it, data is meaningless. The Accounting Agency empowers other agencies’ automated systems to perform analytics as per their functions. It also facilitates businesses to access analytical tools needed to interact with the information that the agency may sell them for their business needs.

Big data is defined as structured or unstructured data collected by a business during its operations. The data is too large to be processed by traditional data-processing tools. In the community, agencies and businesses collect data at ever-increasing rates, with the data coming in all forms.

The Accounting Agency provides the necessary big data analytics tools that businesses and other agencies can use to harness the potential of big data, resulting in data-driven decisions. The obvious results of this approach include more effective marketing and better approaches to revenue collection.

Data security, integrity, and cybersecurity

Data is a valuable resource that businesses can use to power their operations, from engaging with customers to making important strategic decisions and boosting revenues. Community agencies use the extensive information they have about participants to identify how best to serve them, and any gaps that need to be addressed to optimize their operations.

However, this information is not a free-for-all affair. It is strictly controlled by laws and regulations, as well as industry best practice which dictates how information can be used. Data security refers to the measures used to protect private information relating to a business or individual.

The Accounting Agency works with agencies and businesses to ensure that the information they possess and disclose is utilized in line with the law. Privacy rights are strongly adhered to, and all entities are expected to utilize data responsibly. The agency monitors data use to ensure it is consistent with its terms and conditions.

The Accounting Agency works with agencies and businesses so that the data available for analysis is complete, accurate, and reliable. This involves helping them improve their capacity to collect relevant and complete information and store it properly.

The Accounting Agency also handles the community’s posture regarding cyber security. The agency sets up the systems required to do so and constantly monitors them to ensure they are working well. The agency extensively collaborates with other agencies that have any form of infrastructure with internet connectivity, to ensure the community, which is highly connected digitally, is kept safe

How the agency works

Background on presidencies

Every presidency is a four-member entity whose members represent one of the four major demographic groups, known in the community as divisions: partnered males (A), partnered females (B), single females (C), and single males (D). However, a president serves the whole community in their role, rather than only their division. Presidents’ diversity and commitment to serve all is provided for in the community bylaws and ensures that all access services without any discrimination.

These four major demographics are evenly split in a normal society. Each group accounts for between 23 and 27% of the population, with regular fluctuations as people’s status changes. The community appreciates that discrimination across all social categories happens based on whether a person is single or partnered, other social categorizations notwithstanding; partnered males are likelier to dominate other demographics, especially single males and single females.

The community’s infrastructure promotes equal access to economic and social resources and opportunities. The composition of the community as a whole and those who serve it in the community public service is closely monitored to prevent numerical domination, which can lead to nepotism or unequal access.

Besides a person’ status as either partnered or single, the recruitment to be a participant, and to serve in the public service carefully considers other social categorizations, to ensure racial, ethnic, religious, and sexual groups are well represented in the community as they are in the society in which a community operates. These considerations inform the constitution of the community public service. The diversity in community public service, which is provided by bylaws, is aimed at creating a community that is blind to all other considerations besides service to participants. The service is therefore designed to be free of discrimination.

Agency presidency, bureau board, and demographic presidencies

The Accounting Agency is served by an agency presidency, comprised of 4 presidents from the four divisions, which handles strategy formulation and adjustment, as well as formulating and communicating operational procedures for the agency. Additionally, the presidency facilitates the setting up of the agency’s automated system and adjusts it as necessary to better achieve its goals.

As part of the Records and Knowledge Bureau, the agency presidency forms a bureau board with agency presidencies serving the Publishing and Teaching, and Metrics agencies. The board acts as a check and monitoring tool for individual presidents and agencies, especially when decisions have far-reaching implications for the community. Within the bureau board, three presidents from the same demographic form a demographic presidency. There are four such presidencies in the bureau. The demographic presidency performs an advisory role to presidencies and agencies regarding a particular demographic; it does not have operational or executive authority. The demographic presidency also plays an important role in the mentorship and training of new presidents.

| Demographic presidency A | Demographic presidency B | Demographic presidency C | Demographic presidency D | |

|---|---|---|---|---|

| Agency presidency, Accounting (16) | 16A | 16B | 16C | 16D |

| Agency presidency, Publishing and Teaching(17) | 17A | 17B | 17C | 17D |

| Agency presidency, Metrics(18) | 18A | 18B | 18C | 18D |

Data presidencies and agency council

As part of the Records and Knowledge Bureau, the Accounting Agency is served by a team of 24 Records and Knowwledge Bureau presidencies. Each presidency serves 1 district building, where they interact with executive presidency of the agency that has its offices in that building, and district, village, and branch presidencies. Since each presidency consists of four presidents, there are 96 operational presidents.

Operational presidents implement the strategic plans and policies that the agency presidency formulates. The presidents also interact with contractors and branch presidencies, offering them any facilitation necessary to serve participants better, collecting important information on the system’s functionality, and advising the agency presidency on how this system can be improved. They monitor the system to ensure it is meeting the participants’ expectations and needs.

Each agency, on top of being served by an agency presidency, is also served by a trustee presidency, and a regulatory presidency. Together, the three presidencies form an agency council. The council, comprised of 12 members, meets every month, on the last Friday to discuss important agency business.

Limited partners and branch presidencies

Limited partners and dependents

A limited partner is the basic unit in the community. A limited person, usually above 18 years old, but sometimes as young as 16, has been admitted into the community and has invested $20,000 as partnership interest, for which they earn a return. This is regarded as one unit of partnership interest.

Over time, a limited partner can add more units of partnership interest, as their business prospers. The more partnership interest units a limited partner has, the more the return they receive from the Capital Bank.

A dependent is a minor, or a person living with a disability, under the care of a limited partner. In some instances, a dependent may be a fit adult, who for various reasons is supported by community agencies, and assigned by contract to a limited partner. Limited partners are responsible for any legal agreements that their dependents enter into, either with community agencies or other participants, and therefore have the right of attorney.

Together, limited partners and dependents are referred to as participants. Participants who are dependents, because they are still minors, can start a business when they reach 12 years of age. This allows them to save up and invest $20,000 into the community by their 18th birthday, and possibly as early as 16.

Limited partners and their dependents reside in apartments (village buildings). Each apartment has 4 floors, with each floor containing 16 apartments. Each floor has floor has 7 – 12 limited partners, with each limited partner having 1 – 3 dependents. Each floor therefore has around 25 residents. With four floors, each building has approximately 100 residents. An apartment building also forms a branch.

Limited partners and unit

A limited partner is the basic unit in the community. A limited partner, usually above 18 years old, but sometimes as young as 16, has been admitted into the community and has invested $20,000 as partnership interest, for which they earn a return from the Capital Bank Agency, which invests other community agencies. This is regarded as one unit of partnership interest. Over time, a limited partner can add more units of partnership interest, as their business prospers. The more partnership interest units a limited partner has, the more the return they receive from the agency.

A dependent is a minor, or a person living with a disability, under the care of a limited partner, and who has, in any of these cases, given their power of attorney to the limited partner. In some instances, a dependent may be a fit adult, who for various reasons is supported by community agencies, and assigned by contract to a limited partner. Limited partners are responsible for any legal agreements that their dependents enter into, either with community agencies or other participants. Together, limited partners and dependents are referred to as participants.

Participants who are dependents, because they are still minors, can start a business when they reach 12 years of age. This allows them to save up and invest $20,000 into the community by their 18th birthday, and possibly as early as 16. Limited partners and their dependents reside in apartment buildings (village buildings). Each apartment building has five floors, with four containing apartments. An apartment building also forms a branch.

Captains and branch presidencies

Of the approximately 100 residents in a branch, around 40 of them are limited partners.They are divided into 4 units, each of which has 10 limited partners and their dependents. The limited partner membership in a unit is diverse, containing different social groups that are reflective of the society within which a community operates.

Additionally, a unit contains members of the four main demographics: partnered males (A), partnered females (B), single females (C), and single males (D).

The 4 demographics in the branch form 4 groups, as follows:

- Group 1: partnered males and partnered females

- Group 2: single females and single males

- Group 3: partnered males and single males

- Group 4: partnered females and single females

Within each group, there are different subsets, known as classes, based primarily on age. There is a class for Nursery (0-2), toddlers (3 – 5), young children (6-9), pre-teens (10-12), teens (13-18), young adults (19-31), adults (32-72), and empty nesters (73+).

| Meeting week | Class 1 | Class 2 | Class 3 | Class 4 | Class 5 | Class 6 | Class 7 | Class 8 |

| Week 1 and 3 | All partnered adults | All single adults | Teen boys and girls | Pre -teens | Young children | Toddlers | Nursery | |

| Week 2 and 4 | All males | All females | Teen boys | Teen girls |

Further details on the composition of units, groups, classes, and branches, and their meeting schedules, is detailed here.

Recruitment and diversity

Captains are responsible for recruiting limited partners into the community through their council and by extension, branch. A captain does not recruit limited partners only from their demographic. Instead, they work to ensure that their recruits are diverse, considering social categorizations, gender, and social status, in addition to demographic groups.

Captains work in concert with their fellow captains in the branch presidency, and other presidencies in a village and district to ensure that the district is as diverse as possible. They are guided by present data on how diverse their district, village, and branch are, and what needs to be focused on to improve. They are also guided by community bylaws, which expressly require diversity as shown by demographic data about a population from which the community intends to recruit limited partners.

The captain serves as a service extension of the Residential Rental Agency, though they also act as an interface between participants and other community agencies. For agencies that do not have operational presidencies, such agencies in the Economic and Public Administration Bureaus, captains come in handy in helping participants navigate these agencies’ automated system and other relevant tools used by the agency to deliver services.

The automated system is designed to help participants with all the help they need in matters related to various agencies, including the Residential Rental Agency. However, should they run into problems, captains assist them in navigating the system, or direct them to relevant contractors who help them at a fee.

Automated system

The Accounting Agency uses an automated system to deliver on its mandate. The system provides the tools needed to keep accounting information, and an opportunity to train participants and community public servants. If a participant has an issue using the system, they can hire a contractor, though it is envisaged that with sufficient training and regular adjustment to accommodate users’ needs, this will be a rare occurrence.

The automated system employs accounting process and robotic process automation. Accounting process automation refers to the automation of accounting processes such as settling accounts payable, preparing financial reports such as balance sheets and profit and loss accounts, and information sharing. Through APA, manual intervention and the use of spreadsheets to record and synthesize information are minimized, and in many cases, eliminated.

Robotic process automation refers to the use of robotic systems to carry out simple, repetitive tasks such as keying in transaction details. The automation form uses programmable bots to centralize information, such that a simple transaction is immediately analyzed in financial terms and shared with relevant platforms that the business uses.

Besides helping in accounting processes, the automated system also plays a critical role in training. Training modules are uploaded by contractors, after which the system, by observing what each participant needs, prescribes the necessary training for them. This involves the use of machine learning and AI, as well as cloud computing to identify trends, analyze huge amounts of information, and design the best training approach and material for each user.

Contractors

The Accounting Agency registers qualified accountants to work as contractors in the community. Contractors provide specialized services to participants at a fee. The services involve helping their clients to navigate the system and consultancy. Through the agency’s registration and accreditation system, participants and contractors can easily connect. Before registration, the agency establishes a contractor’s qualification, specialization, experience, and other relevant details. These make it easier for participants to locate the contractor they need when the need arises.

With the help of the automated system, the community needs 2 accountants per village, which has 400 businesses. This translates to around 200 accountants in the community. Operational presidencies interact extensively with the contractors in an attempt to streamline their operations and identify areas of the automated system that can be improved. Each of the 24 operational presidencies who serves a district interacts with 8 contractors. Since the operational presidencies also serve the Publishing and Teaching, and Metrics agencies they also interact with contractors in these agencies in the same fashion as they do with accountants.

Interagency collaboration

The 24 community agencies form three columns, of 8 agencies each. The Accounting Agency is part of the first column. While agencies in a column do not enjoy the same level of collaboration as the three agencies in a bureau, they work together on a few areas of common interest. For the Accounting Agency, there is close coordination with the Business Planning Agency (agency 19). businesses evaluate different business plans based on the financial information available. The Accounting Agency also works with the IP Agency as participants work to commercialize their innovations. The Accounting Agency provides the necessary financial analysis and data to determine whether the investment in research and development will be worth what the IP may make once produced.

The Accounting Agency collaborates with the Community Bank (agency 7) as it works to process transactions into financial statements and reports. The agency also works with the Agricultural Land and Surrounding Areas Agency (agency 22) in assets’ financial management.

Presidencies’ offices, meetings, and quarterly conferences

Offices

The Accounting Agency’s presidency has permanent offices on building 16’s western side. On the eastern side, the trustee and the Regulatory Bureau presidencies that serve the Accounting Agency, as well as District 16, have their offices.

Trustees and the regulatory operational presidencies alternate their offices. Trustees have the offices in building 16 on Tuesdays and Thursdays, while the operational presidencies use the offices on Mondays and Wednesdays, as shown in this timetable:

| Building 4/ Health and Nutrition Agency | Building 16/ Accounting Agency | |

|---|---|---|

| Monday | Trustee presidency | Regulatory Bureau presidency |

| Tuesday | Regulatory Bureau presidency | Trustee presidency |

| Wednesday | Trustee presidency | Regulatory Bureau presidency |

| Thursday | Regulatory Bureau presidency | Trustee presidency |

Records and Knowledge Bureau presidencies have offices on the first floor of every district building, with each of the 24 presidencies occupying offices in one building. This graphic shows district building 16’s first-floor layout, with offices for the executive presidency, trustees, and various operational presidencies indicated.

Working hours and meetings

Agency presidents, trustees, and regulatory agency presidents work in their offices on a full-time basis. To allow for this, they are required to be at least 50 years of age, be experts in NewVistas concepts, an be semi or fully retired from their business. This allows them to dedicate much of their productive time to serving the community.

Other presidencies work from Monday to Thursday, from 8 – 8:45 AM. their offices are converted for this purpose, and can thereafter be used for other activities, such as office space for participants, hotel rooms and hospital consultation rooms. On Thursday, the whole presidency (four presidents serving A, B, C, and D) meets for a 45-minute meeting from 9:00 to 9:45 in the morning.

On the last Friday of each quarter, between 9:00 AM and 12:00 PM, each demographic presidency meets. The three-member presidency discusses common bureau matters that are of interest to the demographic they serve. On Saturday, again between 9:00 AM and 12:00 PM, the whole board meets, where the presidents present their input from the previous day’s demographic presidency meeting, and prepare for the quarterly conference. The aim is to have a cohesive presentation during the quarterly conference but tailored to specific demographic interests.

Quarterly conferences

Quarterly conferences are held on the last Sunday of each quarter, from 9:00 AM to 3:00 PM, with a lunch break in between. During quarterly conferences, each demographic presidency sits together in the same row.

Quarterly conferences are held in District Buildings 5 and 17. Each building has a lower and higher assembly court. The different demographic groups use the assembly courts as follows:

| Building | Assembly court | Demographic |

|---|---|---|

| 5 | Lower court | Partnered males (A) |

| 5 | Higher court | Partnered females (B) |

| 17 | Lower court | Single females (C) |

| 17 | Higher court | Single males (D) |

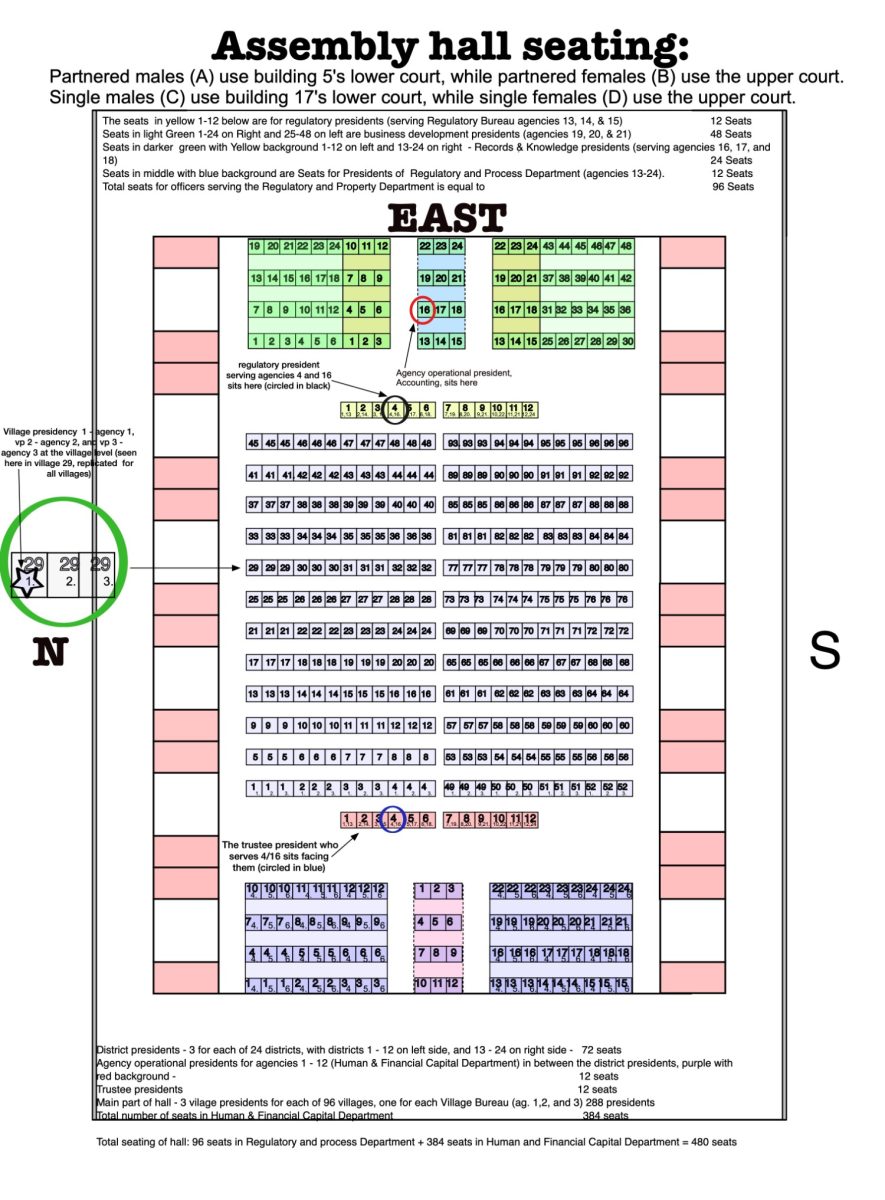

Each of the four assembly courts has seats for 480 presidents representing the respective demographic. In the diagram below each of the 4 courts is illustrated. The ceiling of each court has an elliptical arch that enables agency presidents, who are the only ones who make a presentation during the conference, to speak without the need of amplifying their voice. The 480 seats are easily rotatable to enable presidents to face whoever is speaking. Each of the four courts has an identical arrangement and number of seats. The exact arrangement of each court can therefore be illustrated using one court, in this case, building 5’s lower court that is used by partnered males (A).

Within an assembly court, the 480 presidents are arranged in terms of demographic presidencies of 3. The Records and Knowledge demographic presidency for partnered males (16A, 17A, and 18A) sits as highlighted in the graphic below.

The 24 operational presidents for partnered males (A) are organized into 8 demographic presidencies: 1,2, 3/ 4, 5, 6/ 7, 8, 9/ 10, 11, 12/13,14,15/ 16,17,18/ 19,20,21/ and 22,23,24.

Some additional notes/definitions from an earlier version of this page:

- Among other factors, an entity’s financial performance and efficiency is tied to its financial reporting. This is especially so when the accounting function is not just an archiver of historical records, but takes an active role in planning. In the community, the Accounting Agency will be enable the community infrastructure perform at full capacity (Chen, F., et al. “Financial Reporting Quality and Investment Efficiency of Private Firms in Emerging Markets.” Accounting Review, Forthcoming (2010): electronic.).

- Studies have shown that online training can, when conducted properly, have greater rewards than in-person training. It saves time and resources, and due to the flexibility allowed, can result in better outcomes for the trainees. This will augur well for the Accounting Agency, which has neither the time and other resources required for in-person training, nor the organizational capacity to execute it (Sandlin, C. “An Analysis of Online Training: Effectiveness, Efficiency, and Implementation Methods in a Corporate Environment.” East Tenessee University (thesis) (2013): 1-26. electronic.).

- In contemporary organizations, the bottom-line (net profit/earnings/surplus) can be enhanced through reduced wastage, expenses and other factors. This means that the more efficient an organization is, the more its bottom-line will grow (Lean-CPA. Efficiency helps the bottomline. 2019. 01 06 2019.).

- Through sound financial reporting practices, accounting departments and entities help organizations build up, and benefit from, “reputational capital.” The community is build on among other things, the integrity of its systems, and the ability of its structures to prevent fraud and misrepresentation, which could severely impair judgement. The Accounting Agency’s work will help in actualizing this (Jackson, K. Building Reputational Capital: Strategies for Integrity and Fair Play that Improve the Bottom-line. Oxford: Oxford University Press, 2004.)

- Financial ratios are used to examine and compare an organization’s financial structure, health, and to provide a more general, yet detailed report on the entity’s performance. The use of ratios in the community will detail both the community economy’s performance, while also detailing the community agencies’ actual financial performance (Adedeji, E. “A Tool for Measuring Organization Performance using Ratio Analysis.” 4.19 (2014): 16-22.).

- Businesses, especially small enterprises, highly value business advice given by accountants, with a survey revealing that up to 78% of American small business regard accountants as the primary and most trusted source of business advice. The ability to advice is based on accountants understanding of what financial reporting trends and performance indicators mean, and what can be done to improve business performance through sound financial management. The accounting Agency will be operating in an economy where virtually every business is a small business, in need of accounting advice, which might be impractical to have in-house (Accounting-Today. A small-business barometer for 2019. 06 11 2018. 02 06 2019.).

- Technology is also greatly affecting the way accounting is done in organizations. Powered by blockchain and AI, accounting tools are more advanced, giving businesses better information to make decisions. In the community, participants will need to update themselves on such changes, which could greatly help their understanding of accounting, and harness its power to drive business growth (Tysiac, K. and J. Drew. “Accounting firms: The next generation.” Journal of Accounting (2018): published online.).

- Within the community, the Accounting Agency will be tasked with formulating accounting standards and practice guidelines that help enhance business growth, as well as the accuracy, completeness and reliability of reports. Standards will also provide the community with a standardized financial reporting platform, enabling other community agencies and businesses better interpret the information (Beke, J. International Accounting Standardization. Oxford: Chartridge Books, 2014.)

- Once the standards have been developed, they must then be harmonized with existing GAAPs and FRS, among other standards. This is because financial reports are not for intra-community consumption only, but are also used outside the community, and need to be standardized (HLS. Harmonization of GAAP and IFRS. 27 02 2008. 01 06 2019.).

- With the help of business owners, the Accounting Agency will identify areas which require standards that work for the community. These standards and practices will then be derived, with rigorous examination to ensure that define them and what benefit they give business owners and the community as a whole (FASB. Standard-setting process. 2019. 01 06 2019.)

- Handlers of financial information have a duty to keep such information confidential, especially when it relates to third parties. Disclosure should be backed either by consent of the owner of the information, or under legal instructions to do so (LII. 12 U.S. Code § 3403. Confidentiality of financial records. 2019. 02 06 2019.).

- One of the main reasons why innovations fail is lack of financial planning, coupled with an overconfident innovator who expects instant financial success. The Accounting Agency can help the innovator in better financial planning, in collaboration with other agencies, and give the proposed IP a reality check (Levine, A. Why Innovation Fails. Albany: State University of New York Press, 1980.)